Business

Avtub: Expert Insights, Actionable Strategies & Professional Growth

Introduction to Avtub and its purpose

Welcome to the world of Avtub, where professional growth meets innovative networking. In today’s fast-paced job market, having access to expert insights can be a game-changer for your career. Avtub is not just a platform; it’s a community designed to empower individuals like you with knowledge and tools necessary for advancement.

Whether you’re seeking fresh perspectives or concrete strategies, Avtub offers resources tailored to your unique aspirations. Imagine connecting with industry leaders while honing your skills—sounds appealing, right? Join us as we explore how Avtub can help transform your professional journey into one filled with success and opportunities.

The Importance of Expert Insights in Professional Growth

Expert insights play a crucial role in professional growth. They provide a window into the knowledge and experience of industry leaders who have navigated complex challenges.

Learning from their successes and failures can save time and prevent costly mistakes. This guidance often reflects real-world scenarios that textbooks cannot cover.

Moreover, expert perspectives can inspire new ideas or approaches to problem-solving. Exposure to varied viewpoints fosters innovation and creativity within your field.

Networking with experts also opens doors for mentorship opportunities. These relationships can lead to valuable connections that enhance your career trajectory.

Integrating expert insights into your development strategy equips you with tools necessary for advancement. It’s about transforming knowledge into actionable steps that align with your goals.

Actionable Strategies for Career Advancement

Career advancement requires more than just hard work. It demands a strategic approach. Start by setting clear, achievable goals that align with your long-term vision.

Networking is crucial. Attend industry events and engage with peers on platforms like Avtub. Building relationships opens doors to new opportunities and insights.

Continuous learning should be a priority. Seek out courses, workshops, or certifications related to your field. Stay updated on trends and technologies that can enhance your skill set.

Don’t underestimate personal branding. Curate an online presence that showcases your expertise and accomplishments. Share valuable content relevant to your industry to position yourself as a thought leader.

Seek feedback regularly from mentors or colleagues. Constructive criticism helps identify areas for improvement while reinforcing what you’re doing well in your career path.

How Avtub Can Help You Reach Your Professional Goals

Avtub is designed to empower you on your professional journey. With a wealth of resources at your fingertips, it provides access to insights that can shape your career.

The platform features expert-led webinars and workshops tailored to meet the needs of various industries. Engaging with these resources allows for immediate application in real-world scenarios.

Networking is another powerful benefit of Avtub. By connecting with like-minded professionals, you create opportunities for collaboration and mentorship. This interaction fosters growth beyond traditional learning environments.

Moreover, personalized pathways guide users based on their unique goals and aspirations. Whether you’re seeking leadership skills or technical expertise, Avtub tailors its offerings just for you.

Stay ahead by leveraging Avtub’s extensive community support system. You’re not alone in this journey; countless peers are eager to share experiences and strategies that work.

Success Stories from Avtub Users

Many Avtub users have transformed their careers through the platform. One such story is that of Sarah, a marketing professional who found mentorship and guidance on Avtub. With expert insights, she revamped her strategies and landed her dream job.

Then there’s Jake, an aspiring software developer. He connected with industry leaders who shared invaluable resources and advice. Within months, he secured a position at a top tech company.

Lisa’s journey is equally inspiring. She utilized Avtub to network effectively, attending virtual events that opened doors she never imagined possible. Her dedication led to collaborations with respected figures in her field.

These success stories highlight not just individual achievements but also the power of community within Avtub. Users uplift each other while sharing experiences that resonate across various industries. Each testimony underscores how actionable insights can fuel professional growth beyond expectations.

Connecting with Industry Leaders on Avtub

Connecting with industry leaders on Avtub opens up a world of opportunities. This platform serves as a bridge between aspiring professionals and seasoned experts.

Users can engage in meaningful conversations, gaining insights that are often hard to find elsewhere. Through live discussions, webinars, and networking events, users have the chance to ask questions directly.

Many industry leaders share their experiences candidly, offering guidance that can be pivotal for career growth. The diverse array of fields represented means there’s something for everyone looking to elevate their professional journey.

In addition to advice, these connections often lead to mentorship possibilities. Building relationships with influential figures not only expands your network but also enhances your credibility in your chosen field.

Embracing this opportunity on Avtub could be the turning point you’ve been searching for.

Conclusion: Take the Next Step in Your Professional Journey with Avtub

Your professional journey deserves the right tools and insights. Avtub stands out as a platform designed to empower you with expert knowledge, actionable strategies, and connections that can elevate your career.

By tapping into the wealth of resources available through Avtub, you’re not just gaining information; you’re unlocking potential. Whether it’s engaging with industry leaders or learning from success stories of fellow users, each step on this platform brings you closer to achieving your goals.

Embrace the opportunities that lie ahead. Take charge of your career advancement today by exploring what Avtub has to offer. Your next breakthrough could be just around the corner—make sure you’re equipped for it.

Business

Budget Hacks CWBiancaMarket: Transform Your Shopping Routine Into Major Savings

Introduction to Budget Hacks CWBiancaMarket

Are you ready to revolutionize your shopping experience? With Budget Hacks CWBiancaMarket, it’s time to ditch the impulse buys and start saving smart. With modern financial demands, controlling your spending has become essential. Whether you’re a savvy shopper or just starting out on your budgeting journey, there are endless opportunities for savings waiting at your fingertips.

Imagine walking into Budget Hacks CWBiancaMarket with a game plan that not only keeps your budget intact but also maximizes every dollar spent. From hidden discounts to clever strategies, transforming how you shop can lead to significant financial benefits. Let’s dive into some practical tips and tricks that will help you keep more cash in your pocket while enjoying all that CWBiancaMarket has to offer. Your wallet will thank you!

The Importance of Having a Budget

A budget is your financial roadmap. It guides you through the often chaotic landscape of spending, saving, and investing.

When you have a clear budget in place, you gain control over your money. This clarity helps avoid unnecessary debt, preventing those stressful moments when bills pile up unexpectedly.

Moreover, a well-planned budget allows for better decision-making. You can prioritize essential needs while still setting aside funds for fun or special occasions.

Understanding where every dollar goes fosters mindful spending habits. Instead of impulse buys that can lead to regret, budgeting encourages thoughtful choices aligned with your long-term goals.

In today’s world filled with endless temptations and marketing strategies designed to lure consumers into overspending, having a budget becomes even more crucial. It empowers you to live within your means without sacrificing enjoyment or quality of life.

Identifying Areas for Potential Savings

To effectively save money, it’s essential to pinpoint where your expenses are piling up. Begin by monitoring where your money goes over a 30-day period. This can reveal patterns you might not even notice.

Look closely at recurring subscriptions or memberships. Are there services you’re no longer using? Cancelling these can free up extra cash without affecting your lifestyle.

Next, evaluate daily purchases like coffee shop visits or takeout meals. These small expenses add up quickly. Consider brewing coffee at home instead and packing lunch for work.

Don’t forget about utilities and groceries. Check if you’re paying for more data than necessary on your phone plan or if bulk buying groceries could cut costs over time.

Analyze impulse buys that often derail budgets. A little reflection here can lead to significant savings down the line, giving you more freedom in your shopping routine.

Tips and Tricks for Maximizing Savings at CWBiancaMarket

When shopping at CWBiancaMarket, every little trick counts. Start by creating a digital shopping list. This keeps your attention on planned purchases and prevents unplanned spending.

Timing your visits can also lead to significant savings. Aim for weekdays or early mornings when the store isn’t crowded. You might find markdowns on items that are about to expire.

Don’t forget to check end caps and clearance sections. Often, these areas hide great deals waiting to be discovered.

Consider joining community groups online where shoppers share exclusive deals and tips specific to CWBiancaMarket. Engaging with others can unlock hidden gems and promotions.

Embrace flexibility in brands and products. Sometimes choosing an alternative brand can offer substantial savings without sacrificing quality. Keep an open mind while browsing!

Utilizing Coupons, Deals, and Rewards Programs

Coupons are a shopper’s secret weapon. They can slash prices and stretch your budget further than you might think. At CWBiancaMarket, keep an eye out for weekly flyers or online promotions featuring digital coupons.

Deals often go hand in hand with special events or holidays. Be sure to check the store’s website or app regularly to catch any flash sales that could save you big bucks.

Rewards programs offer another layer of savings. Sign up for CWBiancaMarket’s loyalty program if they have one; points can accumulate quickly with each purchase. These points may lead to discounts on future shopping trips, making every dollar count.

Don’t forget about social media! Follow CWBiancaMarket on their platforms for exclusive deals and time-sensitive offers that aren’t advertised elsewhere. Engaging with these communities can unlock even more savings opportunities tailored just for you.

Planning Ahead for Big Purchases

Planning ahead for big purchases is a game changer when it comes to saving money. Instead of rushing into buying that new gadget or appliance, take time to research and compare prices.

Set a budget specifically for these larger items. Knowing your limit will help you avoid impulse buys that can derail your financial goals.

Start tracking sales cycles and seasonal discounts. Many retailers offer significant reductions during holidays or special events, so mark those dates on your calendar.

Don’t forget about online options too; websites often have exclusive deals not found in stores. Using price alert tools can also notify you when an item drops below your budgeted amount.

Consider waiting before making the purchase. This allows you to evaluate whether it’s truly necessary or just a fleeting desire. Patience pays off by ensuring you’re making informed decisions aligned with your financial strategy.

Incorporating DIY and Thrifting into Your Shopping Routine

Embracing DIY and thrifting can revolutionize your shopping experience. Instead of splurging on expensive items, consider crafting your own solutions or finding unique treasures at thrift stores.

DIY projects allow you to unleash creativity while saving money. Whether it’s upcycling old furniture or creating decor from scratch, the possibilities are endless. Plus, you gain a sense of accomplishment with each completed project.

Thrifting adds an element of adventure to your routine. Each store is like a treasure hunt, where you might discover vintage clothing, quirky home goods, or rare collectibles at unbeatable prices.

Mixing these practices into your regular shopping habits not only stretches your budget but also creates personalized spaces that reflect who you are. So grab those tools and head to the nearest thrift shop—your wallet will thank you!

Conclusion and Final Thoughts

Transforming your shopping routine with budget hacks CWBiancaMarket can lead to significant savings. By understanding the importance of a budget, you empower yourself to make informed decisions. Identifying areas for potential savings is crucial; it allows you to target where adjustments are most impactful.

Maximizing savings at CWBiancaMarket becomes easier when you incorporate smart tips and tricks into your routine. Utilizing coupons, deals, and rewards programs adds another layer of value while planning ahead for big purchases ensures you’re making well-timed investments.

Incorporating DIY projects and thrifting not only elevates creativity but also enhances your overall shopping experience. Each choice contributes to building a more sustainable lifestyle without breaking the bank.

With these strategies in hand, embracing budget-friendly habits has never been more attainable. Your journey towards smarter spending starts today—get ready to reap the rewards!

Business

www .defstartuporg: From Concept to Launch – Complete Roadmap for Startups

Introduction to www .defstartuporg

Welcome to the exciting world of startups! If you have a brilliant idea brewing in your mind, or if you’re itching to turn that concept into reality, you’ve come to the right place. At www.defstartuporg, we believe every great business begins with a spark of innovation and the courage to take action. This platform is designed specifically for aspiring entrepreneurs like you—because turning dreams into successful ventures requires more than just passion; it requires a solid roadmap.

Navigating the startup landscape can be daunting, but fear not! We’re here to guide you through each phase of launching your venture. Whether you’re still brainstorming or ready for launch day, our comprehensive resources and support are tailored just for you. Let’s dive in and explore how www.defstartuporg can transform your vision from mere concept into a thriving business!

Understanding the Concept of a Startup

A startup is more than just a business; it’s an innovative idea striving to solve a problem. This concept often emerges in the tech world but can span any industry.

At its core, a startup aims for rapid growth and scalability. Founders seek to disrupt existing markets or create entirely new ones. The journey begins with identifying gaps and envisioning solutions.

Startups thrive on agility and adaptability. Unlike established businesses, they operate under uncertainty, experimenting with their product-market fit until it resonates widely.

The culture of startups fosters creativity and collaboration among small teams passionate about turning visions into reality. Each challenge faced along the way becomes an opportunity for learning and refinement.

In essence, understanding what makes a startup unique involves embracing innovation while navigating the unpredictable landscape of entrepreneurship.

The Importance of Proper Planning and Strategy for Startups

Proper planning and strategy are the backbone of any successful startup. Without a clear direction, even the most innovative ideas can flounder.

Startups face unique challenges that require meticulous preparation. A well-defined strategy helps in identifying target markets, understanding customer needs, and positioning your product effectively.

Moreover, having a solid plan allows founders to allocate resources wisely. It ensures that time and finances are directed toward areas with the highest potential for growth.

In an ever-evolving business landscape, flexibility is key. A strategic framework provides room for adjustments while keeping core objectives intact.

Investing time in thorough planning not only reduces risks but also boosts investor confidence. With a roadmap in place, entrepreneurs can navigate uncertainties more effectively and inspire their teams to stay aligned with the vision.

Step-by-Step Guide for Launching a Startup through www .defstartuporg

Launching a startup can feel overwhelming. However, www.defstartuporg simplifies the process with a clear and structured approach.

Begin by defining your business idea. What problem does it solve? Identify your target audience early on to shape your offerings effectively.

Next, create a solid business plan. This document should outline your goals, strategies, financial projections, and marketing plans. A well-thought-out plan is crucial for attracting investors or partners.

Once you have clarity on these aspects, focus on building your brand identity. Choose an appealing name and logo that resonates with potential customers.

After establishing the foundation, it’s time to develop a minimum viable product (MVP). This version of your product will allow you to gather feedback without excessive investment upfront.

With everything in place, leverage the community at www.defstartuporg for mentorship and networking opportunities as you prepare for launch day.

Utilizing Resources and Support Available on www .defstartuporg

www.defstartuporg offers an extensive array of resources tailored for aspiring entrepreneurs. From mentorship programs to funding opportunities, the platform acts as a launchpad for innovative ideas.

One standout feature is access to industry experts who provide invaluable insights. Their guidance can help you navigate complex market challenges effectively.

Networking is another crucial element. Connecting with peers who share your vision encourages teamwork and creates new opportunities for collaboration.

The educational materials available are rich in content, ranging from webinars to articles covering diverse startup topics. These resources equip you with the knowledge needed to avoid common pitfalls.

Additionally, community forums allow users to share experiences and advice. This sense of belonging enhances motivation during tough times in the entrepreneurial journey.

Utilizing these tools on www.defstartuporg can significantly enhance your chances of success, turning concepts into thriving businesses.

Common Challenges Faced by Startups and How www .defstartuporg Can Help?

Startups often encounter a myriad of challenges that can hinder their growth. One significant hurdle is securing adequate funding. Many entrepreneurs struggle to find investors willing to back unproven ideas.

Another common issue is market competition. New businesses must differentiate themselves in crowded markets, which requires strategic planning and creativity.

Time management also poses a challenge; founders juggle multiple responsibilities, leading to burnout if not handled effectively.

www.defstartuporg provides essential resources tailored for these obstacles. With guidance on creating compelling pitch decks, startups can attract potential investors more easily.

The platform offers market analysis tools that help identify trends and competitive advantages, enabling smarter decisions.

Additionally, membership includes access to mentorship programs designed specifically for new entrepreneurs facing time constraints and operational stressors. This support equips startups with the knowledge needed to navigate tough situations confidently.

Success Stories from Startups Launched through www .defstartuporg

At www.defstartuporg, success stories abound. Entrepreneurs from various backgrounds have transformed their ideas into thriving businesses. Every journey highlights the strength and ingenuity of its creators.

Take the example of a tech startup that began as a simple app concept. With guidance from mentors at www.defstartuporg, they navigated funding challenges and market analysis. Today, this startup boasts thousands of active users and has secured partnerships with major brands.

Another inspiring tale comes from an eco-friendly product line launched by passionate individuals seeking sustainable solutions. Their journey was fueled by resources available on the platform, including networking opportunities and access to industry experts. Now, they’re not only making profits but also contributing positively to the environment.

These narratives highlight how www.defstartuporg can turn dreams into reality through dedicated support and strategic planning for budding entrepreneurs looking to make their mark in the business world.

Conclusion

Starting a business is an incredible journey filled with both challenges and rewards. Utilizing resources like www.defstartuporg can be the catalyst for turning your innovative ideas into reality. With a clear roadmap, strategic planning, and access to invaluable support, you can navigate the complexities of launching your startup effectively.

Embrace the tools and insights offered by www.defstartuporg to overcome common obstacles faced in entrepreneurship. The success stories from others who have walked this path serve as inspiration and proof that with determination and the right guidance, achieving your dreams is within reach.

Whether you’re just brainstorming or ready to launch, remember that every great startup begins with a single step. Equip yourself with knowledge, connect with supportive communities, and take action towards bringing your vision to life through www.defstartuporg. Your entrepreneurial adventure awaits!

Business

SEO for Startups and B2B SaaS Marketing: A Comprehensive Guide

Startups need growth. But they do not have unlimited money.

SEO for startups means building organic traffic through search engine optimization in a structured way. It focuses on startup growth, customer acquisition, and long-term visibility. Unlike traditional SEO, startup SEO works with limited resources, fast timelines, and strong competition.

A startup SEO strategy aligns with business goals from day one. It supports revenue and business growth. It reduces dependency on paid ads. It builds long-term search visibility in Google and other search engines.

For B2B SaaS startups, SEO marketing plays a bigger role. SaaS SEO supports long sales cycles, content marketing, and product-led growth. Companies like HubSpot and New Breed built demand through organic search before scaling paid channels.

SEO for startups includes:

- Keyword research

- Technical SEO

- On-page optimization

- Content marketing

- Link building

- Website optimization

- Tracking organic traffic and leads

It works as a 10-Step Blueprint. You align leadership, define SEO goals, fix your website, create quality content, build topical authority, earn backlinks, and track results.

Organic growth compounds. Paid ads stop when money stops. That is the difference.

Why SEO is a Good Investment

Startups often ask: is SEO business profitable?

Yes — when done correctly.

SEO is a good investment for early stage SEO and seed stage SEO because it builds a long-term asset. Your website becomes a growth engine. Your organic search traffic keeps working even when your marketing budget is tight.

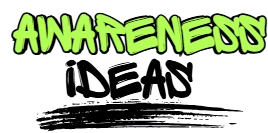

For startups working with limited budgets, platforms like group buy SEO tools providers can reduce software costs while still giving access to premium SEO tools.

Generate Higher Returns at Lower Costs Over Time

Organic traffic compounds. Each optimized page increases SERP visibility. Each blog improves your backlink profile. Each keyword ranking reduces customer acquisition cost.

Paid ads through PPC, Google, or Meta Ads generate instant traffic. But once spending stops, traffic drops.

SEO builds:

- Sustainable website traffic

- Lower CAC through organic search

- Long-term startup marketing strategy

- Minimum viable SEO foundation

For startups in The Nation and even SEO for startups in Nigeria or Africa, organic search creates equal opportunity. You do not need the biggest ad budget. You need the right keywords and quality content.

Over time:

Organic traffic increases. Leads increase. Conversion rate improves. Marketing budget pressure decreases.

That is why SEO for startups is not an expense. It is an asset.

Build Trust with Your Potential Customers

Search engine ranking builds brand awareness. When your startup appears consistently in organic search, users trust you more.

Trust signals include:

- Optimized quality content

- Strong on-page SEO

- Backlinks from high-authority sites

- Clear website structure

- Consistent publishing

If your competitors dominate search visibility, they control the conversation. Your startup must compete in SERP ranking.

For SaaS startups, content marketing for startups builds authority. Technical SEO for startups ensures your website loads fast and works on mobile. Local SEO for startups builds trust in your area.

When people search:

- SEO for startup business

- SEO optimization for a startup website

- SEO friendly website design for startups

Your brand should appear.

Trust turns into leads. Leads turn into revenue. That is startup success.

How to Do Effective SEO: A Step-by-Step Blueprint

SEO for startups works when it follows structure. Random blogging does not work. You need a clear SEO roadmap for startups.

Here is the 10-Step Blueprint used by strong startup SEO teams.

1. Get Buy-In From Leadership

Startup SEO fails when leadership sees it as “just marketing.”

SEO must connect to revenue and business goals. Leadership needs to understand:

- SEO drives customer acquisition

- Organic traffic lowers CAC

- SEO compounds over time

Without leadership alignment, resources disappear when quick wins don’t show.

Show projections. Show competitor search visibility. Show how SEO supports startup growth.

SEO is not a side task. It is a growth channel.

2. Define Your SEO Goals

Clear SEO goals prevent wasted effort.

Set:

- Organic traffic targets

- Keyword ranking targets

- Leads and demo requests

- Conversion rate improvements

Early stage SEO goals may focus on brand awareness and long-tail keywords. Later-stage startups focus on high-intent commercial keywords.

Create a startup SEO roadmap:

Short-term KPIs:

- Indexation fixed

- 20–30 optimized pages

- Initial backlinks

Long-term KPIs:

- Stable organic traffic growth

- Q4 year-over-year improvement

- Consistent qualified leads

Tie SEO goals to revenue, not vanity traffic.

3. Figure Out What Resources You’ll Need

Startups must decide:

- In-house SEO team

- SEO agency for startups

- AI SEO agency for startups

- Offshore talent

Each option has cost and control trade-offs.

Essential SEO tools for startups include:

- Google Search Console

- Analytics tools

- Keyword research platforms

- HubSpot (for content tracking and CRM alignment)

You need:

- Technical SEO support

- Content writers

- Link building resources

- Web design support

Budget planning matters. SEO for startups no budget still requires time investment. Low budget SEO works when priorities are clear.

4. Make Sure Your Website Is SEO-Friendly

Your website is the foundation.

Without technical SEO for startups, content will not rank.

Check:

- Site speed

- Mobile optimization

- Crawl errors

- Indexation issues

- Clean URL structure

- Internal linking

An SEO-friendly website improves user experience and search engine crawling.

Startup website optimization includes:

- Clear navigation

- Logical category structure

- Proper schema

- Secure hosting

If the foundation is weak, growth stalls.

Find Relevant Keywords That Are Easy to Rank For

Keyword research for startups should focus on realistic wins.

Do not chase large-volume, high-competition keywords.

Instead target:

- Long-tail keywords

- Low competition keywords

- Problem-based queries

- Location-based keywords (local SEO for startups)

For example:

- SEO for small startup

- SEO for tech startups

- SEO for SaaS startups

- SEO optimization for a startup website

Seed stage SEO works best with focused niche keywords.

Map keywords to pages. One primary keyword per page. Support with semantic variations.

Find Your Competitors’ Target Keywords

Your competition already shows you the roadmap.

Study:

- Their ranking pages

- Their backlink profile

- Their top-performing SEO content

- Their SERP ranking positions

Look for gaps.

If competitors rank for “best SEO agency for startups” and you don’t have that page, that’s a missed opportunity.

Use competitor analysis to:

- Identify easy-to-rank gaps

- Discover content ideas

- Improve topical authority

Competition analysis reduces guesswork.

5. Optimize On-Page SEO Elements

On-page SEO tells search engines what your page is about.

Optimize:

- Title tags

- Meta descriptions

- Header structure (H1, H2, H3)

- Internal links

- Image alt text

- Keyword placement

Strong on-page optimization improves search visibility without extra cost.

Keep structure clean. Avoid keyword stuffing. Focus on clarity.

Regularly Update Your Content

SEO content ages.

Refresh older pages to:

- Improve rankings

- Update statistics

- Add new internal links

- Improve engagement time

Google rewards freshness when relevant.

Update based on search intent shifts. If users now search “AI SEO agency for startups,” adapt.

Content updates improve Q4 year-over-year growth potential.

6. Create Genuinely Useful SEO Content

Content drives startup SEO.

Many startups publish blog posts but see no organic traffic. The reason is simple. The content does not solve real problems.

SEO content for startups must match search intent. It must answer what users are typing into Google.

For example:

- SEO for startup company

- Affordable SEO services for startups

- SEO for early stage startups

- SEO for SaaS startups

Each query has a different intent. Your content must reflect that.

Content marketing for startups works best when tied to product positioning. SaaS SEO often uses product-led SEO. That means content connects directly to product use cases.

Do not write for traffic only. Write for customer acquisition SEO.

Create Optimized, Quality Content

Optimized quality content includes:

- Clear keyword targeting

- Strong on-page SEO

- Logical header structure

- Internal links

- Conversion-focused calls to action

Build topic clusters around one pillar page. That improves topical authority.

For example:

Pillar: SEO for startups Clusters:

- Technical SEO for startups

- Local SEO for startups

- SEO audit for startups

- Link building for startups

This structure builds semantic SEO strength.

Minimum viable SEO content is better than random publishing.

7. Build Your Site’s Topical Authority

Search engines rank authority, not random pages.

Topical authority grows when your website covers a subject deeply.

If you want to rank for “SEO for startups,” your website must also cover:

- Startup digital marketing

- Startup marketing strategy

- SEO optimization for a startup website

- SEO friendly website design for startups

Topical authority improves:

- SERP visibility

- Brand awareness

- Search visibility

- Backlink acquisition

Content clusters and pillar pages help search engines understand your expertise.

Authority takes time. But once built, it protects rankings from competition.

8. Keep Optimizing and Updating Your Content

Publishing once is not enough.

Review performance monthly.

Check:

- Organic traffic growth

- Conversion rate

- Engagement time

- Keyword movement

Improve weak pages. Merge thin content. Remove underperforming pages.

Content pruning strengthens your website overall.

Updating pages often improves Q4 year-over-year performance.

Agile SEO works well for startups. Small changes compound.

9. Earn Quality Backlinks from High-Authority Sites

Backlinks remain a strong ranking factor.

High-authority sites pass trust.

For startups, link building options include:

- Guest posting

- Digital PR

- Founder interviews

- SaaS partnerships

- Industry directories

Avoid spam links. Focus on relevance.

A strong backlink profile improves:

- Domain authority

- SERP ranking

- Organic traffic

- Startup success

For example, if a Top Solutions Partner in your niche links to you, search engines see trust.

Link building for startups should be steady, not aggressive.

10. Track Your SEO Results

If you do not measure, you cannot improve.

Track:

- Organic traffic

- Leads

- Demo requests

- Keyword ranking

- Engagement time

- Conversion rate

Run a regular SEO audit for startups.

Compare:

- Month over month

- Q4 year-over-year

SEO supports revenue and business growth. It must show data.

Growing organic traffic is not the goal. Qualified leads are.

SEO for Different Types of Startups

SEO for B2B SaaS Startups

SaaS SEO focuses on:

- Long sales cycles

- Educational content

- Feature-based pages

- Integration pages

B2B SaaS marketing depends heavily on search engine optimization.

Companies like HubSpot built massive inbound growth through SEO marketing.

SaaS startups must align content with product use.

SEO for Tech and AI Startups

AI startups compete in high-competition markets.

Common searches include:

- SEO for AI startup

- SEO for ChatGPT startup

- SEO for LLM startup

Tech startups should:

- Publish technical content

- Build thought leadership

- Target niche long-tail queries

Authority matters more than volume.

Local SEO for Startups

Local SEO for startups helps:

- Service-based companies

- Regional SaaS

- Early stage businesses

Optimize:

- Google Business Profile

- Local keywords

- Location pages

Local rankings drive direct leads.

SEO for Bootstrapped and No-Budget Startups

SEO for startups no budget requires focus.

Prioritize:

- One niche

- One pillar topic

- Consistent content

- Internal linking

Growth hacking SEO means doing fewer things better.

Affordable SEO services for startups can help when time is limited.

Common Startup SEO Mistakes

Startups often:

- Ignore technical SEO

- Target high-competition keywords

- Publish thin content

- Skip link building

- Avoid tracking

SEO fails without structure.

When to Hire an SEO Agency for Startups

Consider hiring when:

- Traffic is flat

- No internal expertise

- Technical issues persist

- Scaling content becomes difficult

Compare:

- In-house team

- SEO agency for startups

- AI SEO agency for startups

Choose based on resources and goals.

The best SEO agency for startups shows:

- Clear roadmap

- Transparent reporting

- Proven results

- Industry understanding

B2B SaaS Marketing Agency Solutions

Startups move fast. But SEO, content, PPC, and product positioning require structure.

Many founders begin with DIY SEO. That works early. But as competition increases, outside support becomes useful.

A B2B SaaS marketing agency brings:

- Clear execution

- Technical SEO depth

- Content systems

- Paid and organic alignment

- Defined reporting

The goal is simple: drive demand, implement structured SEO marketing, and reduce complexity in your tech stack.

Request an Assessment

Before scaling, you need clarity.

A marketing assessment shows:

- Current search visibility

- Keyword gaps

- Technical SEO issues

- Content performance

- Backlink profile strength

- Conversion tracking accuracy

A free marketing assessment helps startups understand what is working and what is not.

This is not guesswork. It is data.

In Your Assessment, We’ll Cover:

- Defined SEO goals

- Website audit

- Competitive analysis

- Resource planning

- Growth roadmap

- Revenue and business alignment

You receive a practical SEO roadmap for startups. Not theory.

Whether you are an AI startup, SaaS platform, or local service startup, the process stays structured.

Our Approach: Flexible Within a Framework

Startups need agility. But they also need structure.

The 10-Step Blueprint remains the foundation. Execution adjusts based on:

- Budget

- Industry

- Competition

- Stage of growth

Agile SEO works best when systems are clear.

The focus:

- Technical fixes first

- Keyword mapping

- Structured content creation

- Authority building

- Conversion optimization

Reduce complexity in your marketing stack. Keep what drives revenue. Remove what does not.

What We Do SEO

Search engine optimization remains the foundation.

Services include:

- Technical SEO for startups

- On-page SEO

- Off-page SEO

- Link building

- Startup SEO strategy

- SEO audit for startups

We improve search visibility and organic traffic through structured execution.

Marketing

SEO works best when aligned with marketing.

Services include:

- PPC management (Google & Meta Ads)

- Demand generation

- Campaign tracking

- Marketing automation alignment with HubSpot

- Performance reporting

Paid and organic channels should support each other.

Product

Product positioning affects rankings.

We support:

- Website optimization

- Conversion rate improvements

- Feature-based landing pages

- Clear Web Copy

- SEO-friendly messaging

Strong product pages convert traffic into leads.

Dedicated Offshore Talent for Marketing Specialization

Startups often struggle with hiring.

Full-time senior SEO strategists are expensive. Building a full internal SEO marketing team takes time.

Dedicated offshore talent solves this gap.

You get:

- Technical SEO specialists

- Content writers

- Link building experts

- PPC managers

- Web design support

This model supports startup digital marketing without inflating payroll.

Offshore teams work as an extension of your internal leadership team. Clear reporting keeps everything aligned.

It works well for:

- Early stage SEO

- SaaS startups

- Tech startups

- Venture-backed companies

Resources stay flexible as your growth changes.

Specialized Built-to-Scale Support for Complex Service Work

Some startups operate in complex industries:

- Legal

- Industrial construction

- Healthcare

- SaaS platforms

- Nationwide service businesses

These require structured execution.

Built-to-scale support means:

- Clear workflows

- Defined SEO goals

- Structured content production

- Backlink acquisition systems

- Ongoing SEO audit cycles

Complex service work needs discipline. Random marketing does not scale.

Fit-for-Purpose Teams, Built to Scale

Growth changes needs.

Your marketing structure must adapt without disruption.

Talent That Fits Your Practice

Every startup has a different model.

A B2B SaaS startup differs from an e-commerce startup. A local startup differs from a nationwide platform.

Teams are matched based on:

- Industry

- Stage

- Budget

- Competition

That improves execution speed.

Scalable Delivery

As organic traffic grows, demand increases.

Scalable delivery ensures:

- Content volume increases without losing quality

- Link building scales gradually

- Technical updates stay consistent

Growth should not break your system.

Reliable Continuity and Security

Continuity matters.

Startup marketing suffers when teams change frequently.

Reliable continuity ensures:

- Knowledge retention

- Stable SEO strategy

- Consistent reporting

- Secure data handling

Security and structured processes protect your website and performance data.

Full Transparency. Zero Guesswork.

Data removes confusion.

You should see:

- Organic traffic trends

- Keyword ranking movement

- Leads generated

- Engagement time

- Conversion rate

Transparent reporting builds confidence.

Proactive Partnership

Startups move quickly.

Marketing support must stay proactive.

Instead of reacting to ranking drops, teams monitor performance regularly.

Instead of waiting for Q4 year-over-year review, adjustments happen monthly.

Proactive work supports startup success.

Talent for Every Service Discipline

Growth requires multiple skills.

Support can include:

- SEO strategists

- Content specialists

- Web design professionals

- PPC managers

- Technical developers

This connects WEBSITES, Design & Development, PPC, Content, and SEO into one system.

Operate With Complete Confidence

Confidence comes from:

- Clear strategy

- Defined SEO roadmap

- Consistent reporting

- Structured execution

When leadership understands progress, decision-making improves.

SEO for startups becomes predictable instead of uncertain.

The Red Olive Advantage

SEO for startups works when execution is consistent.

Red Olive focuses on measurable outcomes, not surface metrics. The goal is simple: improve search visibility, increase organic traffic, and convert that traffic into qualified leads.

Show Up Online

If your startup does not appear in search results, competitors win by default.

Strong SEO marketing ensures your brand shows up when potential customers search.

This includes:

- Technical SEO

- On-Page SEO

- Backlinks from high-authority sites

- Quality content

- Clear website structure

Search visibility leads to awareness. Awareness leads to opportunity.

Consistent Success

Consistency separates growth from stagnation.

SEO is not a one-time campaign. It is ongoing execution built around a structured startup SEO strategy.

Monthly reviews. Quarterly improvements. Q4 year-over-year growth comparisons.

Results compound.

Noteworthy Results

Real numbers matter.

- Moved from #70 to #1 for “Jacksonville Industrial Construction” for a nationwide design build construction company.

- Engagement time increased 50.21% in Q4 year-over-year for a Baltimore Criminal Defense Law Firm.

- Leads increased 45.57% in Q4 year-over-year for an Indiana Custom Home Builder.

These results show structured SEO, content, and backlink strategy working together.

From Jacksonville to Baltimore to Indiana, consistent execution drives measurable impact across industries.

Our Happy Clients Aren’t the Only Ones Praising Our Work

Red Olive continues to deliver structured SEO marketing across The Nation.

Recognition follows performance.

Areas of Expertise

01 WEBSITES // Design & Development

Expert Web Design supports SEO-friendly structure. Clean code. Fast loading. Clear navigation.

Website performance directly affects search engine ranking.

02 PPC // Google & Meta Ads

PPC supports organic strategy.

Google and Meta Ads generate short-term visibility while SEO builds long-term growth.

Paid and organic channels should align.

03 Content // Web Copy and More

Content drives authority.

Strong Web Copy improves:

- Engagement time

- Conversion rate

- SERP ranking

- Backlink attraction

Content must match search intent and business goals.

Become One of Our Success Stories

SEO for startups works when it is structured, measured, and aligned with revenue.

Red Olive’s SEO strategists focus on:

- Increasing exposure

- Expanding customer base

- Improving search visibility

- Driving qualified leads

Success stories are built through consistent execution, not shortcuts.

Book a Call With an Expert

If your startup needs structured growth, request a consultation.

A clear marketing assessment shows your current position and next steps.

Web Design

Your website is the foundation. Without strong design and development, SEO struggles.

Schedule a Free Consultation Now

Start with clarity. Build with structure. Grow organically.

Grow Your Startup’s Traffic Organically on a Budget

SEO for startups remains one of the most cost-effective growth channels.

It supports:

- Organic traffic growth

- Customer acquisition SEO

- Long-term search visibility

- Reduced dependency on paid ads

Affordable SEO services for startups make growth possible even with limited resources.

Follow the 10-Step Blueprint. Align leadership. Define SEO goals. Build topical authority. Earn backlinks. Track results.

Organic growth compounds.

That is how startups scale.

-

General6 months ago

General6 months agoFelixing: A Philosophy of Turning Simple Ideas into Wonders

-

Health5 months ago

Health5 months agoLufanest: Effective Local Anesthesia with Fewer Risks

-

General6 months ago

General6 months agobardoek: The Artistic Heritage Inspiring Modern Creative Trends

-

Entertainment5 months ago

Entertainment5 months agoهنتاوي.com: Your Gateway to Arabic Anime Content

-

General5 months ago

General5 months agoDiscover Anonib AZN: An Anonymous Asian Forum

-

Fashion7 months ago

Fashion7 months agofashionisk .com – Your Ultimate Guide to Trendy, Smart Fashion

-

Lifestyle7 months ago

Lifestyle7 months agoMariano Iduba: A Visionary Leader in Global Digital Growth

-

Fashion7 months ago

Fashion7 months agoCasîo: Explore Legacy, G-SHOCK Watches, Keyboards, and More